Overview

Deductible overtime hours are the hours that employees can deduct from their overtime pay for tax purposes. The tax deduction only applies to the overtime premium portion of pay required under the Federal Fair Labor Standards Act (FLSA), aka FLSA-qualified overtime compensation (QOC).

Example of FLSA Qualified Overtime Compensation(QOC):

- Employee’s regular rate is $20/hr

- Overtime rate is $30/hr (20×1.5=30)

- The QOC would be $10/hr premium, aka, the extra half-time portion (the .5x premium) of the total overtime rate.

**Applicable only to businesses paying workers in the United States.

Considerations

The number of deductible hours may differ from the total number of overtime hours an employee may have. This is due to the federal OT policy being 40 hours a week. For example:

- You have your weekly overtime threshold set to 36 hours

- An employee works 44 hours in that week

- The total overtime hours you pay out would be 8 (44-36=8), but the deductible overtime hour total would only be 4 based on the federal policy (44-40=4).

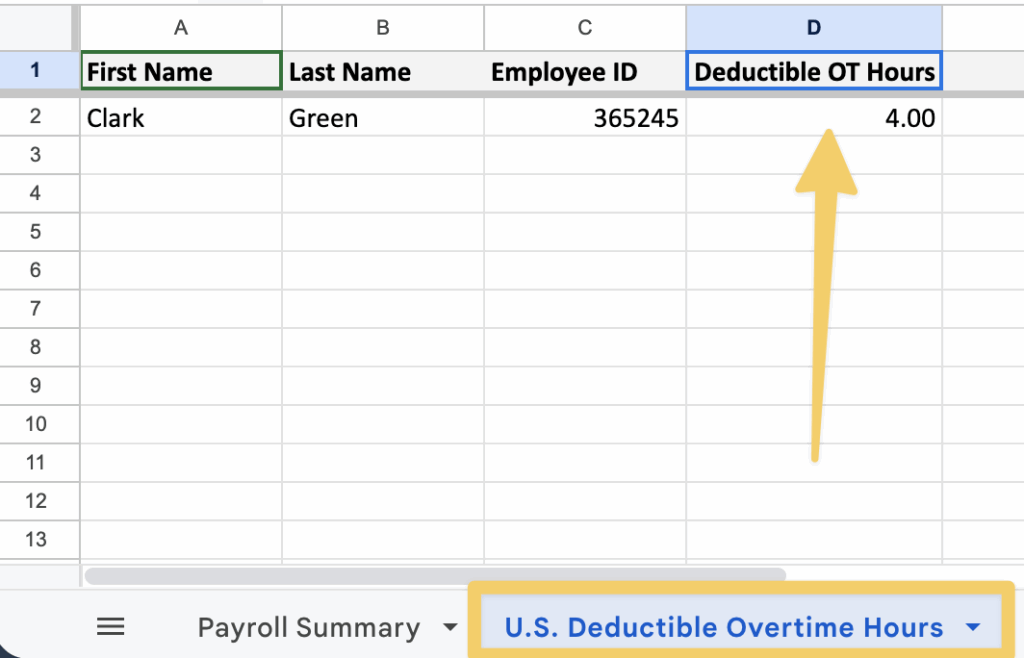

Tracking in the Export

- Close and export your pay period

- Open the file on your computer

- Click on the tab labeled U.S. Deductible Overtime Hours

- Review the “Deductible OT Hours” column for the total number of hours for each user in that pay period